Reminder letters issue from Revenue

AGENT COPY

Income Tax Return

1 Jan 2018 - 31 Dec 2018

Dear Sir / Madam,

Your client has been advised:

That the Self Assessment deadline for filing their 2018 Income Tax return has passed and that they may now be liable to a surcharge.

That by filing their 2018 return now and submitting a payment in respect of tax due, they may avoid:

- the possibility of being selected for audit or other Revenue intervention

- an estimated tax assessment being raised, and a referral for enforcement

- prosecution, associated costs and publicity.

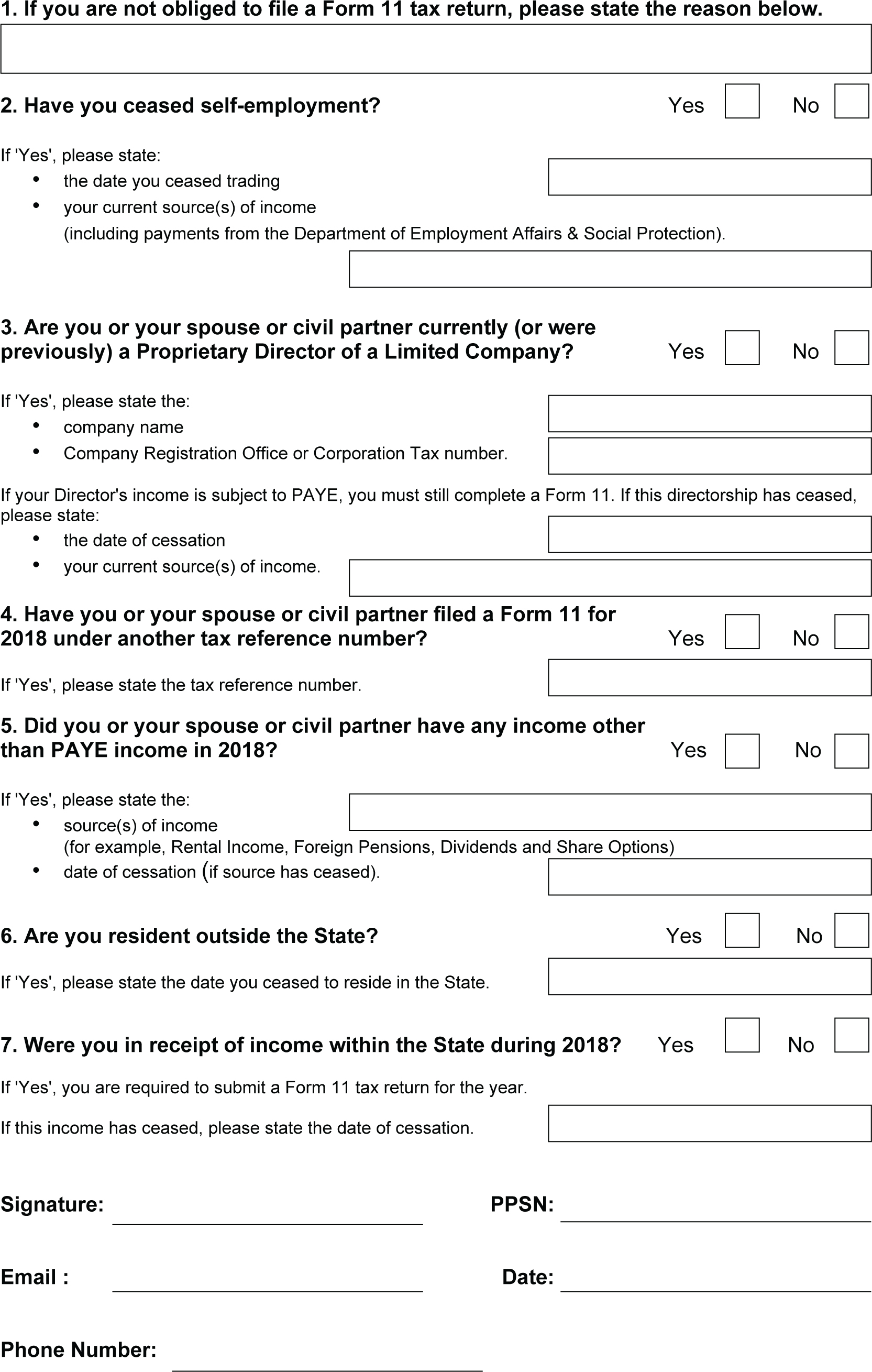

On the back of the letter is a questionnaire which your client has been asked to return, completed, to Revenue. This will assist in reducing further unnecessary correspondence with your client’s Revenue office.

No contact with this office is required if you are in the process of submitting your client’s tax return.

Yours faithfully,

Liz Reid

District Manager

WARNING NOTICE

Income Tax Return (Form 11) for 2018

Dear Customer,

As the self-assessment deadline for filing your Form 11 has passed, you may now be liable to a surcharge.

By filing your Form 11 now and submitting a payment in respect of tax due you may avoid:

- the possibility of being selected for audit or other Revenue intervention

- an estimated tax assessment being raised, and a referral for enforcement

- prosecution, associated costs and publicity.

When filing your Form 11, please keep in mind that we will verify your declaration against all information at our disposal.

You can find more information on filing tax returns online on www.revenue.ie. To help us to update our records, please complete the questionnaire overleaf and return to this office.

Yours faithfully,

Aisling McEvoy

District Manager

WARNING NOTICE

Accounting period ending in the year ended 31 December 2018

Dear Sir/Madam,

This letter is issued to you in your capacity as Secretary to the above company.

It has come to my attention that the company has not filed a CT1 return for the above period. The Self-Assessment deadline for filing the company’s CT1 has passed and the company may now be liable to a surcharge.

To avoid prosecution, associated costs and publicity, please file your company’s CT1 immediately by using the Revenue Online Service (ROS). Information on filing tax returns online is available at www.revenue.ie. There is no need to contact this office if you are in the process of filing your company’s Corporation Tax return.

Important: Financial Statements

Please note that in addition to filing your company’s CT1 you may also be required to submit the Financial Statements for the same period for your company in iXBRL.

Where you are required to file the Financial Statements, you will not be compliant for Corporation Tax purposes until both the CT1 and associated Financial Statements are filed.

When filing your CT1 please ensure your Form 46G, if appropriate, and VAT RTD are also returned fully completed.

Yours faithfully,

Aisling McEvoy

Branch Manager

Source: Revenue Commissioners Copyright Acknowledged