Claiming capital allowances for property fixtures

Introduction

Capital allowances are one of the most significant tax reliefs available in the Irish tax system. In 2018 the value of capital allowances came to over €9.46 billion with 352,243 claims made. Property expenditure is generally the most expensive undertaking for businesses so every opportunity to maximise capital allowances claims is a must.

Subject to satisfying various conditions, expenditure incurred on plant and machinery will qualify for Wear and Tear Allowances (or WTAs), which can be claimed at 12.5 percent per annum over eight years.

In the context of property expenditure, there are two main types of claims which can be categorised as claims for chattels (i.e., loose equipment within buildings), and plant and machinery fixtures claims. Claims for plant and machinery fixtures are available for a proportion of the expenditure incurred purchasing a property or for construction projects including developments, fit-outs, refurbishments and extensions.

Why do taxpayers find it difficult to make claims for property fixtures?

Taxpayers generally recognise entitlement to capital allowances for loose equipment or chattels within buildings, however the more valuable claims for plant and machinery fixtures attached to buildings are often underclaimed or not claimed at all. This can be due to several factors including complexity surrounding the tax legislation and case law which underpin capital allowances entitlement, and accessing professionals in the construction sector with the skillset to assist with such claims.

Before exploring these factors further, we will consider the value of making such claims.

The value of property fixture claims

Typical qualifying amounts for property purchases, developments, refurbishments, etc., are set out in the chart below. The figures shown relate to fixtures only. Additional capital allowances could be available for qualifying chattels, however the value of such claims are generally a fraction of fixtures claims.

Note: Figures shown above are indicative based on CA Partners experience. Capital allowances are subject to entitlement and a detailed analysis being undertaken. Actual claim figures can range from zero to the upper end of the ranges shown (excludes chattels).

Taking a modern air-conditioned office development as an example, for every €1 million spent, it is possible that up to €350,000 could relate to plant and machinery fixtures, qualifying for WTAs. For the purchase of an office building, a claim of up to €300,000 could be available for every €1 million of expenditure. The lower percentage for a purchase compared to a development is mainly down to the land value. Where an office property is refurbished, a claim of up to €800,000 could be available for every €1 million spent. There is no question of the financial benefits to making such claims, therefore we now examine what’s involved in preparing claims.

Making the claim for chattels and fixtures

With a basic knowledge of tax legislation and case law, determining what qualifies as plant is generally a straightforward process. When preparing such claims, expenditure detailed in ledgers and backup invoices are analysed and qualifying expenditure is identified based on an interpretation of basic case law and the legislative conditions set out in section 284 TCA 1997.

However, where claims for plant and machinery fixtures are concerned, the relevant case law is anything but straightforward, and establishing accurate values to justify a tax compliant claim can be an onerous and time-consuming process. Fixtures claims have the following additional knowledge requirements:

- comprehensive understanding of case law “tests” to determine what qualifies as plant;

- a detailed knowledge of case law relating to plant and machinery fixtures;

- for leased plant and machinery, knowledge of the additional entitlement conditions of section 298 TCA 1997;

- knowledge of other relevant sections of legislation is needed in certain scenarios (e.g., section 311, 287, 299 TCA 1997 often apply);

- proficiency in construction costings, building contracts, and procurement;

- expertise in construction technology, terminology and building systems;

- for leased property – interpreting lease agreements;

- understanding the interaction of capital allowances legislation with other areas of tax; and

- ability to undertake land valuations (for purchase claims).

The additional skill requirements set out here can best be addressed by combining the skills of a chartered surveyor with a tax adviser to achieve an outcome that provides the taxpayer with an accurate capital allowances claim, that has considered all relevant legislation and case law.

For a claim to be successful, the first step should be to undertake thorough due diligence to ensure that entitlement exists. Depending on the scenario, various sections of TCA 1997 may need to be referred to, but the following basic conditions of section 284 must always be satisfied:

- a trade or profession must be carried on;

- capital expenditure must be incurred on the provision of plant and machinery;

- it must be used wholly and exclusively for the purposes of a trade;

- it must belong to the claimant; and

- it must be in use for the purposes of the trade.

Landlords with rental property can also claim allowances, however the additional conditions of section 298 TCA 1997 apply, whereby the burden of wear and tear must fall directly on the lessor (i.e., the landlord) of the plant and machinery, and a claim must be made within 24 months after the end of the chargeable period.

In determining whether a landlord bears the burden of wear and tear, it is important to consider the terms of the lease agreement as well as the commercial practicalities of any arrangements between landlord and tenant. Reviewing case law including Macsaga Investment v. Lupton [1967]1 and Lupton v. Cadogan Gardens [1971]2 can help to establish who bears the burden of wear and tear in a particular situation.

Once entitlement to claim has been established, it is possible to determine the scope of the claim and to begin the process of establishing a reasonable and justifiable claim figure.

Let’s now consider how tax compliant claims should be prepared for purchases and capital projects.

Making the claim for property purchases

Where a property is purchased for a lump sum, there is no breakdown of the constituents of the purchase which comprise the non-qualifying land, the non-qualifying building structure, and qualifying plant and machinery fixtures attached to the building.

Subject to entitlement and comprehensive justification of the claim amount, where an existing property is purchased, taxpayers are entitled to claim capital allowances for expenditure relating to qualifying plant and machinery fixtures. Such claims are made under section 311 TCA 1997, which allows a just apportionment of plant and machinery to the property purchase price. Comprehensive substantiation is required to justify making such claims, and a relevant historical Revenue precedent reference IT963520 states that a professional valuation should be provided. The generally accepted approach to substantiating a claim involves the following steps:

- Carry out thorough due diligence to establish entitlement to claim.

- Undertake a building reconstruction cost estimate.

- Carry out a reconstruction cost estimate for plant and machinery fixtures attached to the building.

- Prepare a bare site land valuation.

- Apportion the values of land, building and plant and machinery fixtures to the purchase price paid.

- The claim value is established based on the apportioned value of plant and machinery fixtures.

This process is designed to calculate a just apportionment claim in accordance with legislation and Revenue guidance, however other valuation methods may also be relevant depending on the circumstances.

Making the claim for capital projects

Where a capital project is undertaken such as a development, refurbishment or a fit-out, a building contract is entered into with a contractor to carry out the works and a project team is appointed.

A review of the accounting information associated with the project will identify lump sum interim payments for the works in a ledger and/or invoices from a contractor, and such costs are typically treated as non-qualifying. However, hidden behind these payments is a large volume of information relating to the building contract, including hidden costs relating to qualifying plant and machinery fixtures. These fixtures are typically underclaimed or not claimed at all due to a lack of awareness and understanding of the true value of making such claims, difficulties in understanding building contracts and other factors.

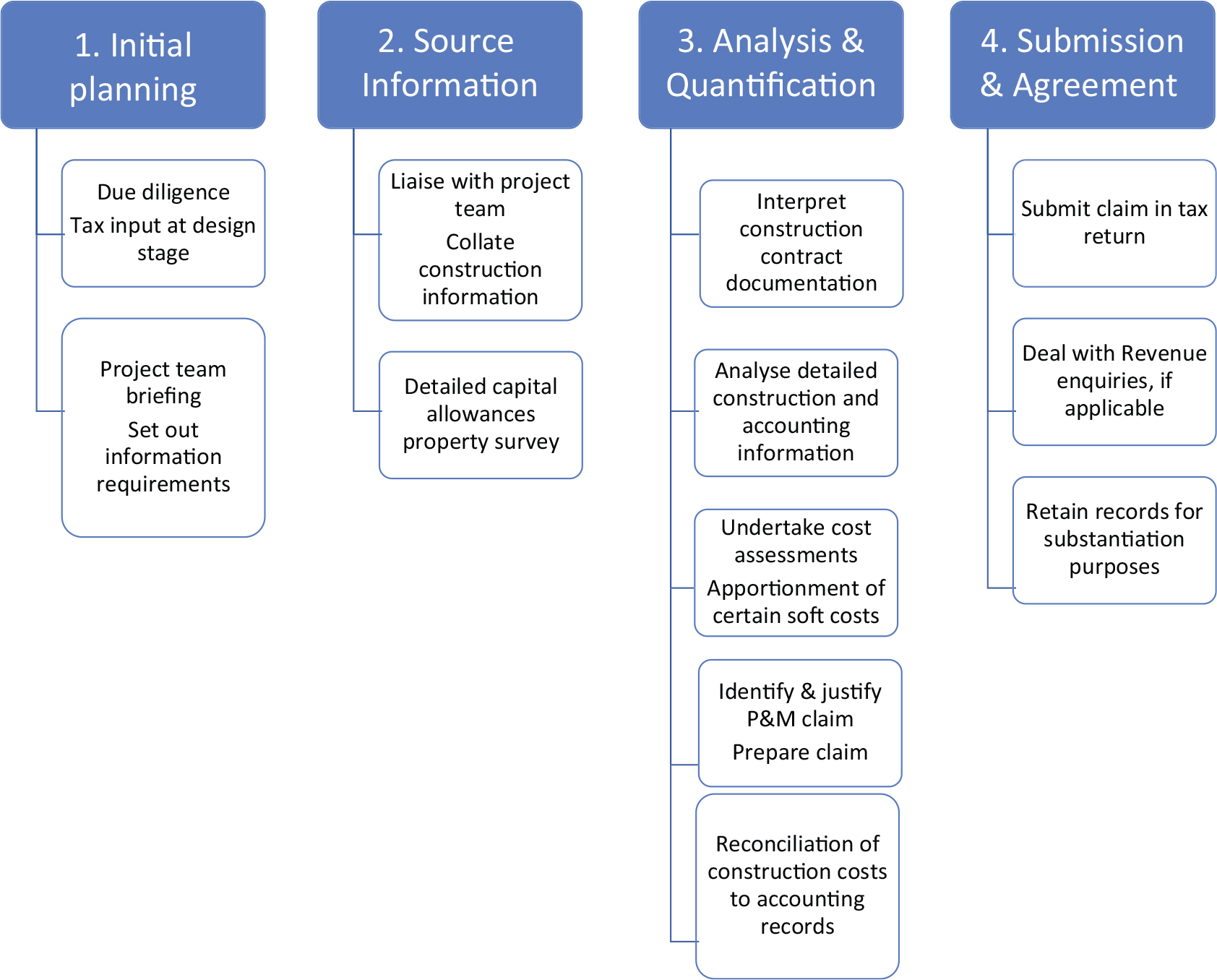

This chart sets out a suggested process to prepare a claim for a capital project.

To achieve a maximised claim that is tax compliant and robust to Revenue scrutiny, it is important to engage tax experts and chartered surveyors who possess expert knowledge of construction technology, building systems, cost information, procurement and building contracts.

To justify the value of any claim and ensure that it is optimised in a tax compliant manner, it is important that the right information is obtained relating to the construction contract and that construction costs are thoroughly analysed. Obtaining input from the project team and ensuring clear communication lines with them will help greatly in this regard.

Risks of making claims

The value of making claims for fixtures is clear, however where there is an opportunity for valuable tax relief, the associated risks should not be underestimated.

In order to comply with legislation, case law and Revenue published guidance, it is important that thorough due diligence is undertaken before any claim for fixtures is considered.

Subject to entitlement, it is essential that the robust and comprehensive substantiation is produced in relation to any claim. Detailed records relating to entitlement, construction and accounting information relied upon and the calculations undertaken should all be retained as substantiation for several years.

Revenue has wide ranging powers and generous time limits for making assessments, therefore the careful preparation of capital allowances claims will ensure that tax underpayments, interest, penalties and publication on the list of tax defaulters are avoided.

Philip O’Connor is managing director of CA Partners who are specialist advisers for property tax incentives. He is a dual qualified tax adviser and chartered surveyor with over 15 years’ experience specialising in capital allowances. T: +353 (0)1 548 4834 | poconnor@capartners.ie